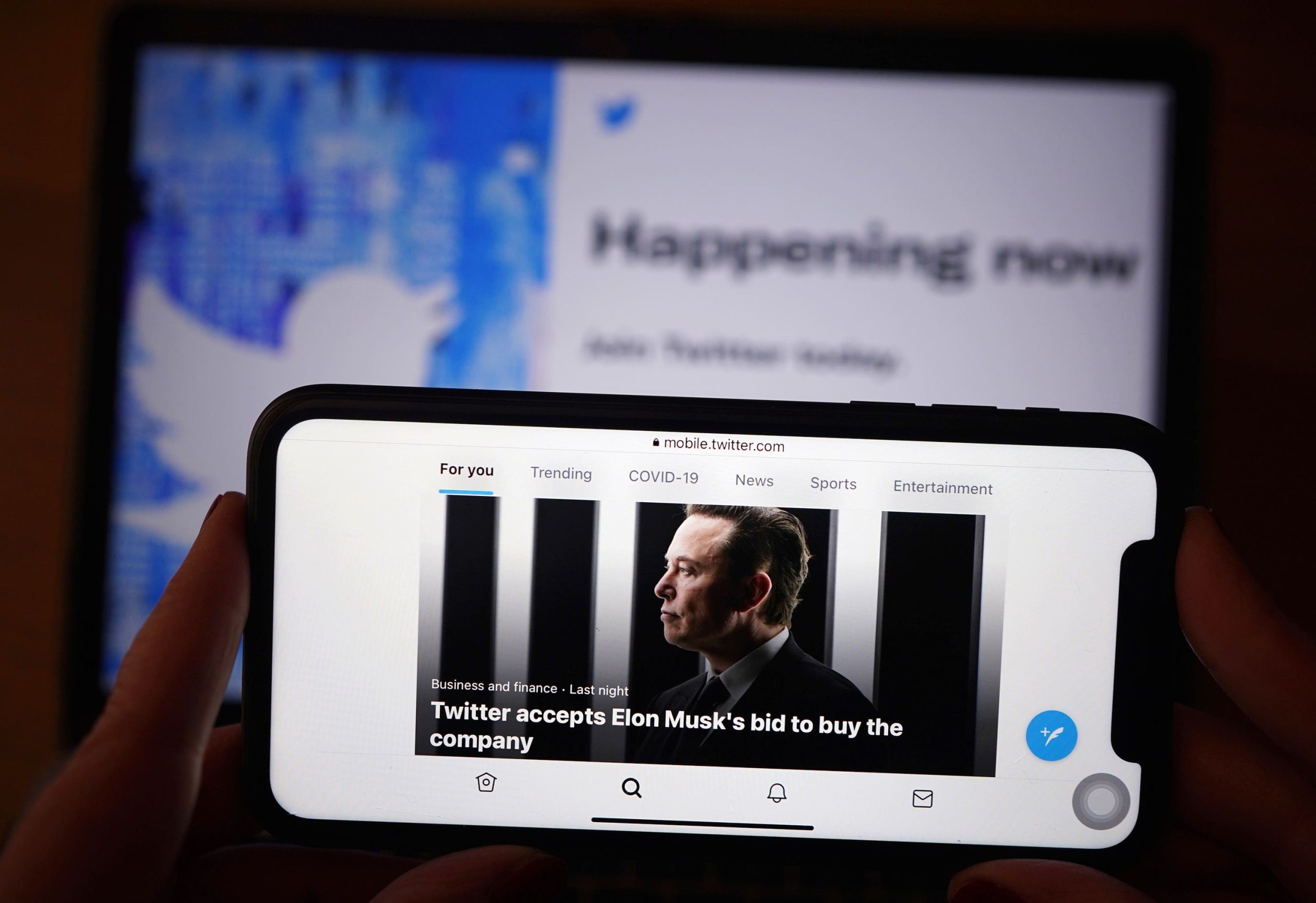

Twitter has revealed higher quarterly earnings but lower-than-expected revenues as it grapples amid growing backlash to this week’s bombshell move to agree a 44 billion US dollar (£35 billion) takeover by Elon Musk.

The social media giant posted earnings of 513 million US dollars (£405 million) for the first three months of the year.

This marks a big leap on the 68 million US dollars (£54 million) reported a year ago, but its 2022 first-quarter profits have been boosted by a near-one billion US dollar (£789 million) gain from the sale of its mobile ad platform MoPub.

It saw first-quarter revenues rise 16% to 1.2 billion US dollars (£947 million), though this was just shy of forecasts for 1.23 billion US dollars (£970 million).

Twitter also reported a jump in daily users, to an average of 229 million in the quarter – around 14 million more quarter-on-quarter and 15.9% higher on a year earlier.

The figures come just days after Mr Musk’s mega-deal to buy Twitter was announced, sparking speculation over the Tesla billionaire’s plans for the platform amid fears over his stance on free speech.

There were also concerns soon after over the financing of the deal after shares in electric car maker Tesla plummeted, wiping more than 125 billion US dollars (£99 billion) off its value as questions swirled over whether Mr Musk would have to offload shares in the group to pay for Twitter.

The takeover fallout continued further, with Twitter’s former chief executive, Dick Costolo, accusing Mr Musk of making one of the website’s senior executives a “target of harassment and threats”.

It came after Mr Musk posted a meme of Vijaya Gadde – Twitter’s head of legal, policy and trust – and appeared to suggest the company had a “left-wing bias”.

Mr Musk’s personal use of the platform is attracting increased criticism as he continues to use it to publicly question policy decisions made by Ms Gadde, which has seen her account flooded with abuse.

San Francisco-based Twitter cancelled a conference call with executives and industry analysts on Thursday that usually accompanies its results, offering little further insight into its financial performance.

It said: “Given the pending acquisition of Twitter by Elon Musk, we will not be providing any forward-looking guidance, and are withdrawing all previously provided goals and outlook.”

Mr Musk’s takeover of Twitter is expected to close sometime this year, subject to shareholder and regulatory approval.

If his bid goes through, the company will no longer have to publicly report its financial results, which have been mixed since the company listed on the stock market in 2013.

The group has struggled to consistently deliver profits as a public company, while its revenue growth has fallen short compared to rivals Google and Facebook.